- Health Is Wealth

- Posts

- Trim Review: The Tool that Automatically Lowers Your Bills & Saves You Money

Trim Review: The Tool that Automatically Lowers Your Bills & Saves You Money

In this Trim review, we’re going to show you how Trim works, what the potential savings are, and help you determine whether using a free tool like Trim to save money is right for you.

Saving money is hard. It’s one of those things that everyone knows they should do, but many people have trouble actually putting money aside.

Whether it’s because you’re just making ends meet or you have trouble with not spending your extra cash, you’re not alone if you have trouble saving. In fact, fewer than 40% of Americans could handle an unexpected $1,000 expense.[1]

So, if you have trouble saving, but want to get started, what’s the best thing to do? Trim looks to give consumers an easy way to save money automatically.

Unlike budgeting software, Trim doesn’t just track your spending. It can cancel unwanted subscription services and negotiate bills on your behalf. This helps you spend less money and actually put that money into savings automatically.

Trim Review at a Glance

Pros

Get alerts to track your spending

Negotiates your bills on your behalf

Helps cancel unwanted subscriptions

Cash back offers help you save money when shopping

Free to use

Cons

Works best if you pay for most things using your debit or credit card

No app. Works through Facebook Messenger or text

Best for: People who need help saving money or who have a lot of subscription services and who need help identifying the ones they can cancel. People who have a handle on their finances and know exactly where their money is going each month will get less use out of Trim.

What is Trim?

Trim is most simply a service designed to help people save money.

Trim was launched in 2015 by Thomas Smyth and Daniel Petkevich. Before launching the company, Smyth worked for investment firms that focused on startups and Petkevich worked for a number of online financial services.

Trim states that its mission is to “build the equivalent of a self-driving car for your financial life.”

Trim helps to automate your finances and give you answers to questions like “Will I have enough money to retire someday? Which credit card should I get? Can my car insurance switch automatically to a cheaper provider?”

How Does Trim Work?

Trim is surprisingly straightforward and easy to use, and it has helped people save hundreds.

Linking Your Accounts

When you create your Trim account, you’ll link all of your financial accounts to the service. That means that you’ll have to log in to your bank account and credit card accounts.

If you’re wary of giving your login information to Trim, that’s a good thing. Trim is extra sensitive to this issue, so much so that the top menu on their sites links to a page specifically covering security. Here’s the first paragraph on that page:

“When we started Trim, the first data we stored were our own transaction histories. Next came transaction data from our closest friends and family. As you can imagine, we care a lot about keeping these crown jewels safe. We built our security systems so that people we know and love would entrust us with their data. We’ll apply exactly the same standards to yours.”

In a nutshell: Trim stores your information securely (via encryption) and has read-only access to your financial accounts. It won’t make changes without your permission.

Subscription Tracking

Once you’ve linked your accounts, Trim will automatically go through them and look at your recent transaction history, as well as your balances. Trim will use this information to generate recommendations specifically for you.

For example, Trim might see that your cable bill two months ago was $40 and that it is now $55. Trim will send you an alert about the increase and offer to call the cable company and negotiate on your behalf.

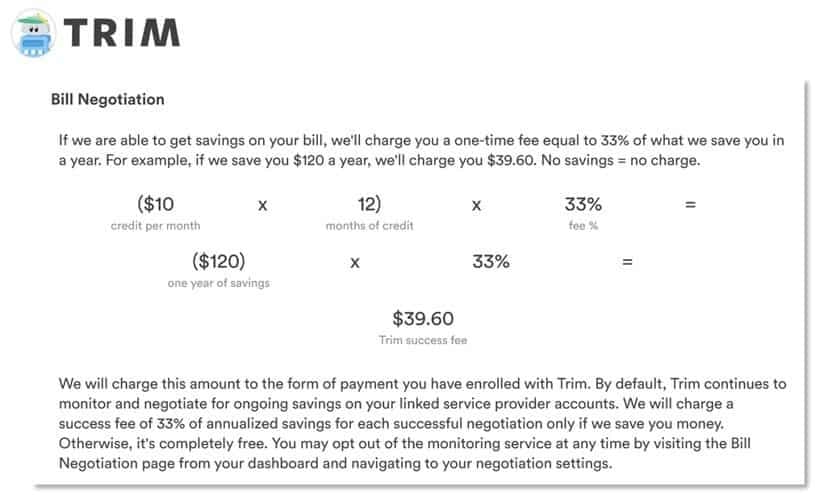

You may have noticed that Trim doesn’t charge a fee for its services. One of the ways that it makes money is by taking a commission. If Trim is able to negotiate a discount in your bill on your behalf, Trim will take a portion of the savings each month. You’ll still pay less than what you were originally, but you might be paying slightly more than if you had negotiated the bill for yourself.\

Here’s how they describe it:

Trim might also notice that you have signed up for five different streaming services. Trim will send you a text reminding you about the services you’ve signed up for and the cost of each (in a non-judgmental way, of course). If you decide that you want to cancel one of them, Trim will handle that for you.

All you have to do is send a text back to Trim saying “Cancel X” where X is the name of the subscription. The service isn’t perfect, but it works more often than not. Trim reports a 70% success rate when it comes to lowering bills.

Transaction Alerts

One of the most difficult parts of managing your money is paying attention to everything that goes on in your financial accounts. Trim can help with that, sending you automatic alerts whenever specific events occur.

By default, Trim can notify you for:

Paydays

Overdraft fees

Late fees

Balance updates

Credit card usages

Large transactions

You can also set custom alerts that will be sent when your checking account balance falls below a threshold that you can set.

These alerts help you stay up to date on your financial situation, making it easier to avoid overspending. Of course, this doesn’t replace having a solid budget, but it’s a great safety net.

Trim Simple Savings

If you really want extra help with saving money, Trim offers the Trim Simple Savings feature. This is a paid service that automated the saving process for you.

For $2 per month, Trim will set up a new savings account for you. This account pays 1.5% interest each year, helping the money you set aside to grow.

Trim Simple Savings will automatically transfer money from your checking account to the savings account each week or month.

For most people, this isn’t a great service to use due to its monthly fee. Nearly every bank allows you to schedule automatic transfers. Sign up for an online savings account with no fee, and you can emulate this service at a lower cost.

Trim Concierge

Trim Concierge provides more personalized financial advice than the automated services that Trim provides.

If you want to use Trim Concierge you’ll have to log in to your account and answer a series of yes or no questions so that your “concierge” can get to know your financial situation. You’ll also be asked about your financial goals. Within 24 hours, you’ll get a text message from your concierge, so you can start discussing your goals and how to reach them.

Your concierge will get to know you personally and provide advice specific to your financial situation. If you want help finding the best online bank accounts, your concierge can give you that advice. If you’re looking for ideas on how to save $20 a week, your concierge can help you come up with strategies.

You’ll communicate with your concierge only by text message. This can be a benefit for people who like to communicate via text. People who want face-to-face interaction, which is understandable with some as high-stakes and personal as money, won’t get that through Trim Concierge.

One nice feature of Trim Concierge is that the price tag is based on what you think the advice you’ve received is worth. You can pay nothing if you’d like, or to pay as much as you can afford to.

Trim Review FAQs

Trim offers a lot of features, so it’s easy to get overwhelmed the first time you look through the list.

Trim anticipates that and offers a handy FAQ page for people who still want to learn more, or who need more clarity, about its services.

Is Trim safe?

Trim uses 256-bit SSL encryption on its website. For non-techies out there, that means, yes, it is incredibly safe. It would take thousands of years to crack encryption of that level. The service also uses two-factor authentication when you sign in, meaning that if someone guesses your password they still won’t be able to get into your account.

What banks does Trim support?

There are too many to list, but odds are good that Trim supports the financial institutions you work with. Overall, the company supports more than 15,000 financial institutions in the US.

Is Trim free?

Yes! The basic services offered by Trim are free to use.

How does Trim make money?

Trim makes money in a few different ways:

Taking a commission on the money it saved by negotiating your bills (only charged once a bill is successfully reduced)

Charging $2 for Trim Simple Savings

When you pay for Trim Concierge

Who should use Trim?

Trim is a great service that a lot of people can take advantage of.

The people who will get the most benefit out of Trim are people who know that they should save money and who want to get started, but who have trouble actually pulling the trigger. People who also aren’t entirely certain where all of their money is going will get great use out of Trim.

Having a service that can tell you exactly what you’re spending money on, without making you look through stacks of credit card statements, makes it easy to figure out what subscriptions you can cut. The fact that Trim can negotiate lower prices for the services you keep is just icing on the cake.

Once you’ve taken the step of cutting unnecessary expenses, you can start putting money into a savings account, and use Trim Simple Savings to automate if you need the extra hand holding (although there are many online banks out there with similar APYs that don’t charge a monthly fee).

Trim Review Summary

Saving money is hard, especially if you don’t know where the money you make is going. Trim helps by telling you how your money is being spent and helping make you more aware of your personal finances.

Given that the basic service is free, there’s no reason not to sign up and try it out if you’re considering it.

The post Trim Review: The Tool that Automatically Lowers Your Bills & Saves You Money appeared first on DollarSprout.